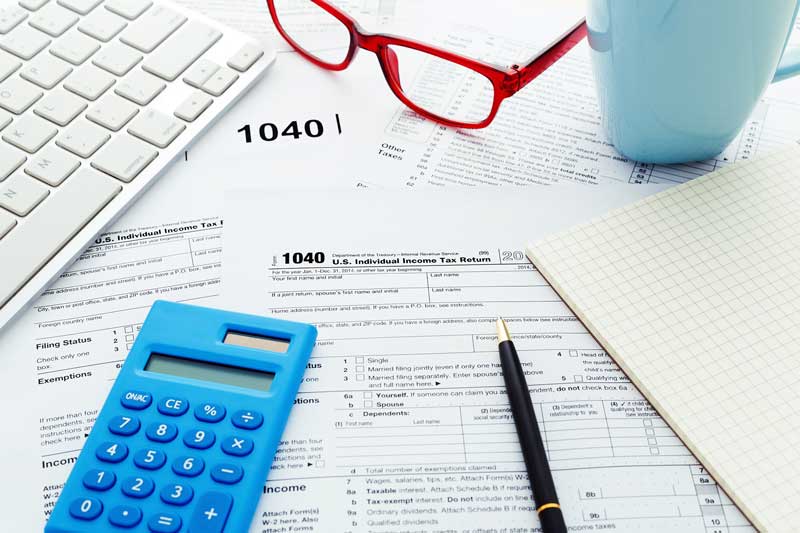

Charitable Donations and Tax Deductions

Are you moving or cleaning out the home of a loved one? Feeling overwhelmed by the sheer volume of unwanted stuff you need to get rid of? Worry no more, the Estate Pros have you covered!

Estate Sales are an excellent option for decluttering, downsizing and cleaning out a home but in some instances an alternate solution is necessary. That’s where a donation and clean out service may come into play. If you’re someone who loves to give back to your community and support causes close to your heart then a household donation may just be your best bet. Not only will a donation and clean out solve your downsize problem but you’ll be glad to know that your generosity may also provide some tax benefits if you qualify.

Charitable giving not only helps others in your community, but as a taxpayer, your charitable contribution may count towards a tax deduction. Deducting donations you’ve made to a qualified charity on your tax return may reduce your taxable income.

Tax Deductions for Charitable Donations

So what is a charitable donation? A charitable donation, or charitable contribution, is a cash or non-cash (property) gift made to a qualified 501(c)(3) tax-exempt nonprofit organization. The donor may receive a reduction on their taxable income through their tax return as a result of their contribution. Otherwise, donors don’t receive anything of value from the charity in return for their donation.

Your non-cash donations of clothing, household goods, etc that are in “good” condition or better are entitled to a tax deduction, according to Federal law. The IRS requires that all charitable donations be itemized and valued.

Standard Deduction:

The standard tax deduction is the most widely used type of deduction taxpayers take advantage of. It is a fixed dollar amount that reduces the income you’re taxed on. The standard deduction:

- Permits a tax deduction including when you have no expenses that qualify for claiming itemized deductions

- Eliminates the need for itemizing deductions

The standard deduction amount will vary each year based on IRS guidelines and your filing status.

Itemized Deduction:

Itemized deductions work differently than the standard deduction but also reduce your Adjusted Gross Income. The standard deduction is a standard (or fixed) amount. Whereas, the itemized deduction is a dollar-for-dollar deduction, and the amount will be different for each taxpayer. The itemized tax deduction amount is determined by adding all applicable deductions and subtracting the sum from your adjusted gross income.

Itemizing your deductions on your tax return, as opposed to, taking the standard deduction will allow you to claim charitable donations on your taxes. When filing your taxes, list your total itemized deductions, including charitable contributions. Should that amount exceed the standard deduction amount for your filing status, you should then itemize. Otherwise, take the standard deduction.

IRS requirements for charitable donations

Unfortunately, the IRS won’t allow you to just deduct any expense; they have some rules about what serves as a tax-deductible donation and where the donation goes. Here is an abbreviated list of what is not deductible as a charitable donation per IRS guidelines:

- Money paid for a raffle, bingo, or lottery ticket

- Amounts paid for tuition

- The value of blood donated to blood banks

- Amounts paid to labor unions, social and sports clubs, civic leagues, and chambers of commerce

- Donations made to most foreign organizations

- Amounts paid in homeowner’s association dues

- Donations made to individuals

- Donations made personal profit groups

- Donations made to lobby groups for law changes

- Donations for political groups or candidates running for public office

Types of qualified charitable organizations

Additionally, the IRS will only let you deduct contributions made to qualified organizations. Your donations have to go to a charitable organization that matches this criteria:

- Churches, temples, and other religious organizations

- Qualified charity groups

- 501(c)(3) non-profit organizations

- Nonprofit schools

- Nonprofit hospitals

- Volunteer responder departments (i.e. fire departments)

- Veterans groups and certain cultural groups

- Public parks, national parks and recreation facilities

Documenting Your Donations

When donating it’s important to keep and maintain all associated documentation that supports your charitable contributions. This will likely include donation receipts, acknowledgment notices, bank statements, photographs of donated items, or any other proof or related documents of your donations such as qualified appraisals or an IRS form 8283.

Keeping records of all related donation documents is critical in being able to prove donations made to charitable organizations while enabling you the opportunity to claim a tax benefit. The IRS has different record-keeping requirements for donations depending on the amount and type of your donation.

Special Requirements for Non-Cash Donations (Donations Over $500 and $5,000)

Which records you need to maintain depends on the value of the donation. In other words, the amount and detail of documentation required by the IRS increases with the donation amount. As it relates to the Estate Pros, we will focus on non-cash donations over $500 as that’s what we specialize in:

Non-cash donations more than $500 but less than $5,000 – You must have a written acknowledgment and record (receipt), which should include the following:

- Organization’s name and address

- Date and location of donation

- Reasonably detailed description of the property donated

Non-cash donations of $5,000 or more – You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items that is more than $5,000 if the organization you donated to gives written acknowledgement and show certain records including a receipt that provides:

- Organization’s name and address

- Date and location of donation

- Reasonably detailed description of the property donated

You may also need a qualified appraisal. Qualified appraisals are necessary for:

- A single donated item or a group of items that is more than $5,000.

- Clothing or household items valued at more than $500 that aren’t in good condition (vintage clothing, for example).

Be aware, you will owe a tax penalty if the donated property’s value is significantly overstated. Additionally, the cost of the required appraisal can’t be used as a part of your charitable donation.

Do you need to fill out and file an IRS Form 8283 for your noncash charitable contributions?

If you donated a total (aggregate) amount of $500 or more in noncash donated property to charitable organizations or claim a deduction for donated property, use Form 8283 to report information about tax-deductible donations. As you complete the form, provide information about the donated property, including its description, cost or adjusted basis, when and how you acquired it, and who you gave it to. Additionally, the charitable organization receiving the donation must provide acknowledgment of the donation on Part IV of the form.

Feeling Overwhelmed?

There’s a lot to consider when downsizing or emptying a home so it’s best to stay on top of it all from the very start!

Donation Value Guides from Major Charities

Below is a list of average prices you can use as a guide for determining the value of your donation. Values are approximate and are based on items in good condition.

Women’s Clothing

- Accessories $2 – $8

- Blouses $2 – $8

- Dresses $3 – $16

- Handbags $2 – $4

- Intimate apparel $2 – $10

- Outerwear $7 – $35

- Shoes $2 – $10

- Skirts $2 – $8

- Slacks $2 – $8

- Suits $5 – $15

Men’s Clothing

- Suits $15 – $40

- Jackets $6 – $20

- Shirts $2 – $6

- Outerwear $7 – $16

- Sweaters $2 – $10

- Accessories $7 – $35

- Shoes $2 – $10

Children’s Clothing

- Dresses $1- $3

- Pants $1 – $5

- Shirts $1 – $5

- Outerwear $3 – $8

- Sweaters $1 – $5

- Shoes $1 – $6

Housewares

- Cookware $2 – $10

- Tabletops $1 – $10

- Vacuums $15 – $25

- Pictures $2 – $10

- Lamps $5 – $30

- Luggage $5 – $10

Furniture

- Kitchen sets $40 – $100

- End tables $2 – $20

- Coffee tables $10 – $25

- Dressers w/mirrors $25 – $60

- Wardrobes $15 – $60

- China cabinets $40 – $150

- Trunks $15 – $30

- Sofas $59 – $125

- Desks $20 – $75

- Recliners $20 – $50

Computers

- Systems $100 -$500

- Monitors $10 – $50

Electronics

- Televisions $20- $170

- Stereo systems $25 – $100

- Radios $5 – $20

Sporting Goods

- Golf clubs $2 – $10

- Bicycles $12 – $60

- Fishing rods $3 – $10

- Skates $3 – $5

- Tennis rackets $2 – $10

Liquidations, Cleanouts, and Estate Sales

There’s a variety of items that can be donated and what each charity accepts will differ based on what they need and what they use the donated goods for.

Here’s some categories of generally accepted donatable items:

- Household goods & furniture – Sofas, chairs, tables, beds, dressers, decor, accessories, artwork, kitchenware, etc

- Clothing & accessories – Men’s shirts, pants, suits, Women’s dresses, blouses, etc. Handbags, belts, shoes, etc

- Electronics & Appliances – Stereo equipment, TVs, refrigerators, etc

- Books & media – Hard and soft cover books, CDs, LPs, DVDs, etc

- Antiques & collectibles – Antique furniture, decor / accessories, collectible artwork, etc

- Vehicles & larger items – Cars, motorcycles, boats, etc

Maximizing Your Deductions

The timing of your charitable donations plays a strategic role in maximizing your tax benefit. Choosing the year in which time your donation is important in reducing your taxable income.

For instance, if you think you’re going to have higher income than usual you may want to plan to donate more and take your deductions to fall during that year. Conversely, you may want to defer donating to a different year if you anticipate lower income taxes during a given year.

It’s important to note that charitable donations are only deductible in the tax year in which they are made, meaning donations made after December 31st of a given year won’t be deductible until the following tax year.

Another strategy is bundling multiple years of charitable giving into one year. This may provide larger gains in your tax benefit by itemizing deductions in a single tax year, versus what you might receive from spreading the donations out over a few years.

Understanding the fair market value (“FMV”) of your items may also be helpful in maximizing your tax benefit. FMV is defined as the estimated price an asset would sell for in the current market under normal conditions, assuming a willing buyer and a willing seller, both acting independently and with reasonable knowledge of the asset’s value.

If the fair market of value of your donation items is fairly high you may want to consider having them professionally appraised. A qualified appraiser can provide you with all of the documentation necessary to ensure you get the largest tax deduction possible for your charitable items.

Donating to charity for tax purposes can be confusing. Avoiding these pitfalls when deducting charitable donations from your taxes is critical to your success:

- Not documenting your donations: A donation receipt is required for any contribution of $250 or more, or of any non-cash item.

- Overestimating the value of what you donated: Generally, you can estimate the value of your donation at what a thrift store would sell it for.

- Not using a qualified charity: A charity typically must be a 501c-3 for your tax donation to be deductible.

Step-by-Step Process

When considering donating furniture and other household goods to charity for a tax deduction you may want to consider taking the following steps to prepare:

Sort your items into different categories – donation items, items you may want to sell, items that need to be either recycled or designated for trash

Research the charity organizations you’d like to donate to – make sure they are a 501(c)(3) qualified non-profit organization, identify what type of items they will accept, do they pick up or will you have to drop off, etc

Make sure to get proper documentation – you will need to get a receipt from the charity documenting what you’ve donated, if you have high priced items you may want to have them professionally appraised, IRS Form 8283 may also be necessary depending on the total value of your donation

Keep a record of what you’ve donated – photograph and make note of all the items you’ve donated so you have a personal record, you may also need this when filing taxes, etc

Special Situations

Some donation situations require specialized procedures and documentation. These scenarios may involve extra steps or specific considerations.

Donating after an estate sale – the decedent may have designated charities they’d like to contribute to with special requests, etc. Also, make sure you know what donor name and address should be used for all of the documentation (name of trust, names of beneficiaries, etc)

Properties & Real Estate – these donations have to be made to a qualified organization and not for use by a specific individual. If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the donation.

Business inventory – these contributions must also be made to a 501(c)(3) and will have other requirements such as during a tax year your total charitable contribution deduction cannot exceed 10% of the corporate taxable income or 15% if food inventory, etc

Working with Professional Services

The donation process can sometimes feel overwhelming, especially if you’re dealing with a large amount of items or when handling a loved one’s estate. Employing professional service providers such as estate sale companies, professional organizers, tax professionals, appraisers, and charitable organizations may assist in making the process a little less stressful.

A professional estate sale company can help you organize, advertise and execute the liquidation of your items along with assisting the donation and junk removal of any leftovers.

Professional organizers can assist in sorting and organizing your items so you’ll know what you are moving, selling, donating and throwing out.

Choosing the right charity ensures your donation items go to the cause of your choice, helping those in need. Make sure the charity you work with is registered as a 501(c)(3) non-profit organization for tax considerations.

A qualified appraiser and a tax professional will help you navigate the donation process determining what has real value and what to expect as far as a tax deduction.

Digital Tools and Resources

There are a number of great resources worth investigating when donating to charity for tax deduction including donation tracking apps, valuation guides for assessing the value of your donated goods, accounting & receipt organizing systems such as Quickbooks, and tax preparation software like TurboTax. All of these tools will help you stay organized and ensure that you get the most out of your donation.

Common Mistakes

Moving and emptying out a home is a very involved and layered process, here’s some common mistakes you should try to avoid in order make it as seamless as possible:

Missing documentation – make sure to keep all of your donation receipts, tax documents, etc in order and in a safe place as you may need to refer to them at multiple points during the process

Overvaluing items – over appraising the value of your donated goods may raise flags with the IRS and could put in you in a position where you may be subject to an audit

Donating to non-qualified organizations – your charity of choice must be recognized as a 501(c)(3) organization in order for your contributions to be considered for your taxes

Missing deadlines – tax day is April 15 so make sure you have everything submitted in time to qualify for your deduction, otherwise, you can file for an extension if you can’t meet the deadline

Incomplete records – make sure you keep a record of all your donations either via spreadsheet, pictures, or both

Tips for Success

Feeling overwhelmed? There’s a lot to consider when downsizing or emptying a home so it’s best to stay on top of it all from the very start!

Creating systems for staying organized is a great place to begin. Categorizing items, creating spreadsheets, taking pictures and physically separating items when possible is recommended. Recruit family and friends when available as this process can be very demanding and exhausting. Making sure the charities you’ve picked are on the schedule and are on time is also important to keep the process moving along without hiccups. You will also want to stay in contact your tax professional so they can guide you and help you plan for tax season appropriately.

Southeast Michigan Estate Sale Service Area

The Estate Pros have been proudly serving Oakland, Macomb and parts of Livingston, Genesee, Lapeer & Wayne counties for the past 15 years. No matter what your situation calls for, the Estate Pros are here to help!

The Estate Pros Difference

Experience

Over 15 years of service with more than 5,000 successfully completed estate sales, liquidations, donations & clean outs.

Professional

Our team has the qualified appraisers and industry leading liquidation experts needed to get the job done right.

Safe

We are licensed, bonded & insured. You can feel confident knowing our services are private, safe and secure.

Results

Ranked in the top 50 estate sale companies in America, delivering millions of dollars in estate proceeds to our valued clients every year.

What Our Clients are Saying

Recent Estate liquidations

Hickory Glen Dr

Bloomfield Hills, MI 48304

Value: $29,510

March 3, 2026

Maddy Ln

Keego Harbor, MI 48320

Value: $29,890

February 27, 2026

Beth Dr

Warren, MI 48088

Value: $26,430

February 24, 2026

Schedule Your House Clean Out & Donation Today!

The Estate Pros are here to help! No matter what your situation is – big or small estates, estates with older or outdated items, estates with location restrictions, etc.

We can handle any situation, location type, or size – GUARANTEED!

House Clean Out & Donations FAQS

The Estate Pros are a professional estate services company that offers full-service donation & residential junk removal services. While we work with many local charities to donate your unwanted items and junk, the Estate Pros are NOT a charity or 501(c)(3) tax exempt organization.

As much as we love our customers, unfortunately, are services are not free. The Estate Pros donation and clean out program is a paid service that offers full-service residential donation & junk removal. Please contact us for details and pricing.

As soon as you know you need service! You can book an appointment with us through our website via our “book online” option or by calling us at (248) 266-9817. We are generally pretty booked up so the sooner you can get on our schedule the better. It’s best to plan ahead!

Our team is typically asked to haul away mattresses, furniture, electronics, etc. We try and take as many of your unwanted items as possible and can take away most residential items as long as it’s not toxic or hazardous. Here’s a list of items we commonly take for donation:

- Furniture & mattresses.

- Household & kitchen items.

- Clothing, shoes, bedding, linens, etc.

- Appliances & electronics.

- Artwork, accessories & decor.

- Office furniture & equipment& more!

Items that can’t be donated will be either be recycled or discarded. Such items may include oversized pieces (pool tables, ping pong tables, large china cabinets, large armoires, etc), holiday decor, toys, etc.

Yes, as long as it can be lifted and loaded into the truck by two people. Additional labor for large item removal such as deconstructing furniture, exercise equipment, carpet removal, etc. may be billed at an hourly rate (please contact us for details).

Our mission is to re-purpose, re-home and donate as much of your unwanted items & junk as possible, assisting others in need while minimizing what needs to be discarded. We donate your furniture and other household items to charities such as Habitat For Humanity, Furniture Bank of SE Michigan and others, providing you with all the required tax documentation for your donations. Items that can’t be donated or recycled will be discarded.

Yes, the Estate Pros are fully bonded and insured. We have liability insurance, general performance bonding, workmen’s compensation, and insurance coverage for all of our trucks and teams. Your home is fully protected in the rare event that damage should occur.

Estate Sale Resources

The Ultimate Guide to Marketing Your Estate Sale (PDF)

Ultimate Guide to Marketing Your Estate Sale (PDF)

Everything you need to know about estate sale marketing and…

Marketing an Estate Sale

Where and how to market your estate for success…

How to Price Household Items for an Estate Sale

Figuring out how to price household items at an estate…